Gain calculator stock

The stock price fell 20. Gain Loss Percentage Calculator.

/Stock-Market-Charts-Are-Useless-56a093595f9b58eba4b1ae5b.jpg)

Calculating Investment Percentage Gains Or Losses

Meeting Your Long-Term Investment Goals Is Dependent On A Number Of Factors.

. This 70 return would be the same if the. When stock market prices took a dive at the beginning of COVID-19 millions of people jumped into the stock market to take advantage of the low prices and millions also sold. Our investment calculator lets you estimate how much your investments may grow.

The calculator will display The Ending Balance value after compounding the gains of 30 consecutive winnings and the Total Gain percentage. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status.

Cash Flow Condors MasterMind Group. Then if you multiply that number by the 15 capital gains it. The stock profit calculation involves all the factors that play a part in determining your net gains.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. Capital Gains Tax Calculator. You could experience a gain one year and a loss the next.

Thus your percentage return on your 10 per share investment is 70 7 gain 10 cost. Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Enter when an investment was first made.

Not sure how well or poorly your trade went. Add multiple results to a. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19.

In other words you have to include the brokers commission and dividends to calculate. Multiplying this value by 50 shares yields 250. Ad Calculate Your Potential Investment Returns With The Help Of AARPs Free Calculator.

Enter an initial investment amount in dollars. Return on Stock Shareholder Total Return Capital Gains Dividends. This means that by compounding the.

A calculator to quickly and easily determine the profit or loss from a sale on shares of stock. Hard 14 MasterMind Group. Bear Market Survival Guide MasterMind Group.

Capital Gain Tax Calculator for FY19. On a per-share basis the long-term gain would be 5 per share. Investment percentage gain Price sold purchase price purchase price 1 0 0 textInvestment percentage gain fractextPrice sold - textpurchase.

Enter a valid active stock ticker ZIP from Tiingo. Our gain and loss percentage calculator quickly tells you what percentage of the account balance you have. Finds the target price for a desired profit amount or percentage.

Learn How We Can Help. If you get a value of 100 this means that if you spend a specific amount on stocks you will have a revenue of. Investments can be taxed at either long term.

New Tax Laws Recently there has. Tackle 25 MasterMind Group. The per-share gain is 7 17 10.

Common Stock Formula Calculator Examples With Excel Template

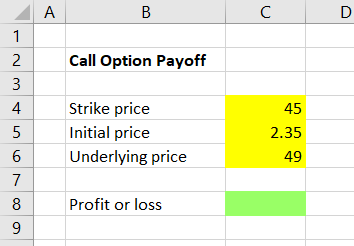

Calculating Call And Put Option Payoff In Excel Macroption

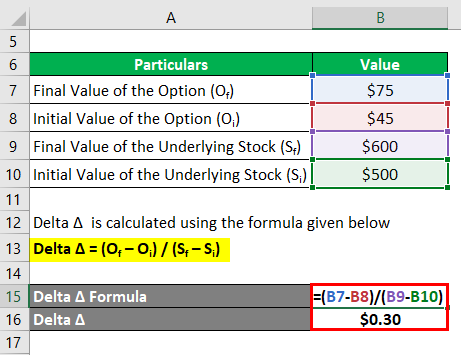

Delta Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

How To Calculate Stock Profit Sofi

Stock Calculator

Capital Gains Yield Cgy Formula Calculation Example And Guide

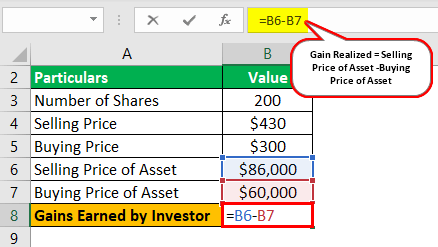

Gain Formula How To Calculate Gains Step By Step Examples

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

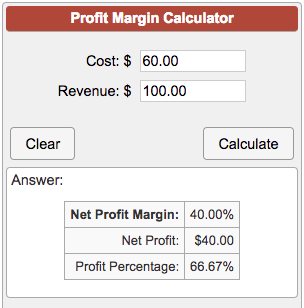

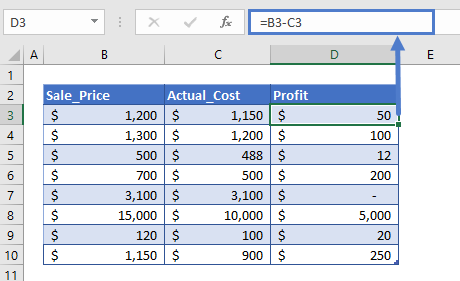

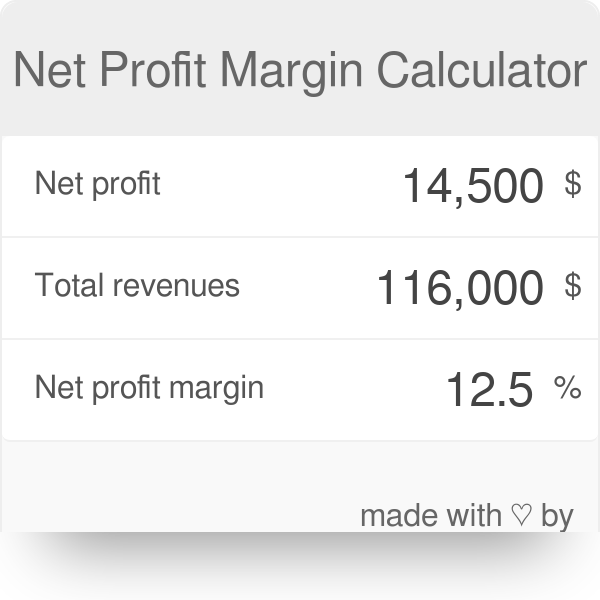

Profit Margin Calculator

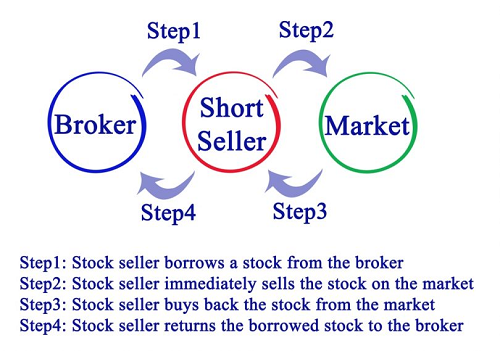

Simple Stock Short Selling Profit And Loss Calculator

Gain Formula How To Calculate Gains Step By Step Examples

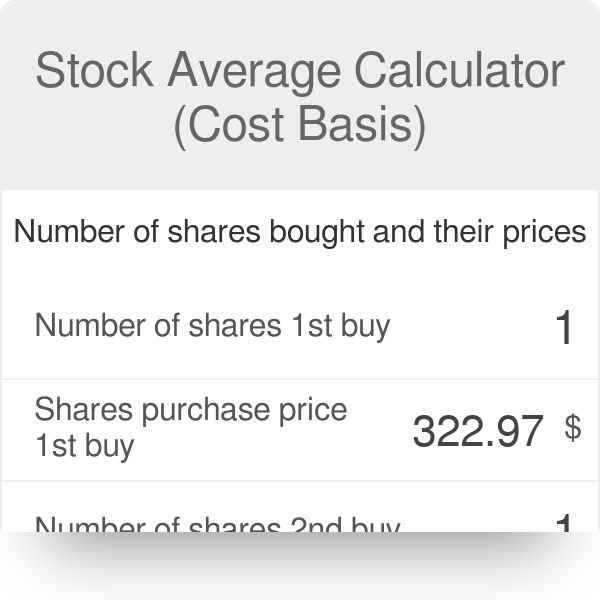

Stock Average Calculator Cost Basis

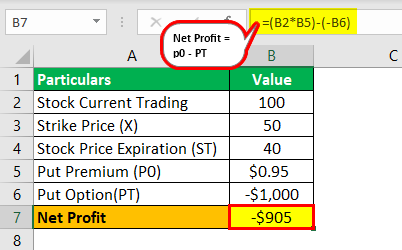

Put Options Definition Types Steps To Calculate Payoff With Examples

Profit Margin Calculator In Excel Google Sheets Automate Excel

Capital Gains Yield Formula With Calculator

Net Profit Margin Calculator